Getting Audited by the CRA?

It is not uncommon to disagree with the results proposed by an auditor. You may feel like the auditor hasn’t correctly verified your income or expenses. One common example is missing receipts or unidentified deposits.

Sometimes you may not be able to provide all the information required even if you do have legitimate expenses. In some cases the Canada Revenue Agency will use the net worth assessment method and propose an assessment that is not based on your income or expenses but instead based upon your personal living situation.

This is an unreliable audit method and is only to be used as a last resort. We provide both audit and appeal representation. We will work with the auditor at our office away from your place of business. We make sure the auditor assesses you in a reasonable manner as outlined by the Income Tax Act and Excise Tax Act.

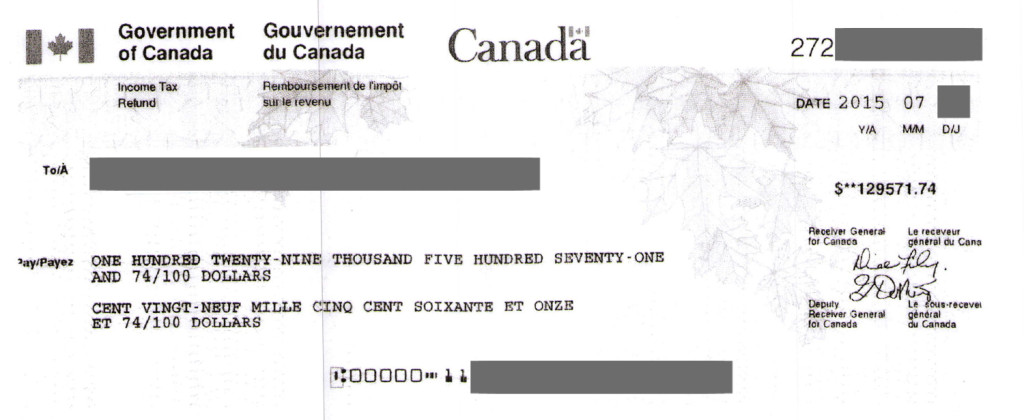

If you disagree with the proposed adjustments we will also undergo an appeal on your behalf. This stops the collection of all income taxes related to the assessment until the issue is resolved.

The CRA Audit Process

What to expect if you have been selected for an audit by the Canada Revenue Agency.

Typically audits fall into many categories including desk audits, field audits, large corporate audits, GST audits, and payroll audits, to name a few.

The Desk Audit

The first and most common audit is what we call a desk audit. Usually, you are contacted by the Canada Revenue Agency through mail. They will typically request very specific items in relation to a recently filed tax return. Proof of your medical expenses, childcare expenses, spousal support payments, or travel expenses are the most common requests. From the time you get the letter there is usually a very short window to respond. Extensions may be granted by calling the auditor. If you provide the requested information, a decision is made quickly to allow your claim or disallow your claim in full or in part. A letter is then issued advising you of their decision and a notice of reassessment is issued if there are changes. If you don’t respond, typically these claims are disallowed in full. Normally there are no penalties in relation to a desk audit.

When the CRA Visits You

The other audits are usually done by an in-person auditor. The auditor will typically first make contact by phone and follow up by letter requesting a time to meet and a list of documents they want to review. An audit will usually be for more than one tax year and will likely include verification of all income and expenses. Typically, a taxpayer is only selected for audit if the agency believes there is a reasonable possibility that a change could be made to the tax return.

At your first in-person meeting the auditor will conduct an interview to get a better understanding of both your accounting practices and of your business. We advise most people to have a proper advocate at this interview. During this meeting an auditor will also take notice of your perceived lifestyle. The auditor writes down what you say at the initial interview and holds you to it. On occasion the team leader accompanies the auditor.

Next the auditor will take the books and records to their office for examination. Sometimes the auditor will request to conduct the audit at your location. We suggest the auditor does the audit at your business location or representative’s location to ensure that the records are not lost.

It is usually a few weeks before contact is made again. Sometimes an auditor will call with specific questions. When an auditor is finally ready to proceed, they will provide you with a proposal letter. This is when our clients normally panic and make contact with us. The first proposal letter is the auditor’s interpretation of what the tax return should say without any input from you. Typically, any assumptions made are not in your favor. You are then usually granted 30 days to provide the auditor with evidence that the proposal letter is not correct. A key thing to remember here is that the burden of proof is on the taxpayer to show that the auditor is wrong.

Remember the auditor is not your advocate.

You Have the Right to Representation

Once representation is made, the auditor will typically provide a new proposal letter and grant an additional two weeks to provide representation. This may go on for a period of time until the auditor has completed the file to their satisfaction and issues a notice of reassessment.

If you disagree with the notice of reassessment it is important that you deal with it right away. After 90 days you could lose your legal rights to object and proceed on to an appeal. What’s worse is that after 90 days the Canada Revenue Agency can proceed with legal action to collect the debt.